how to put instacart on taxes

Instacart 1099 Tax Forms Youll Need to File. Learn how to file your 1040 and reduce taxes as an Instacart shopper in.

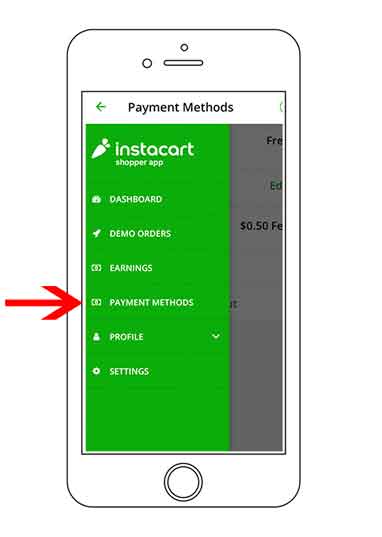

How To Use The Instacart Shopper App Download Login More

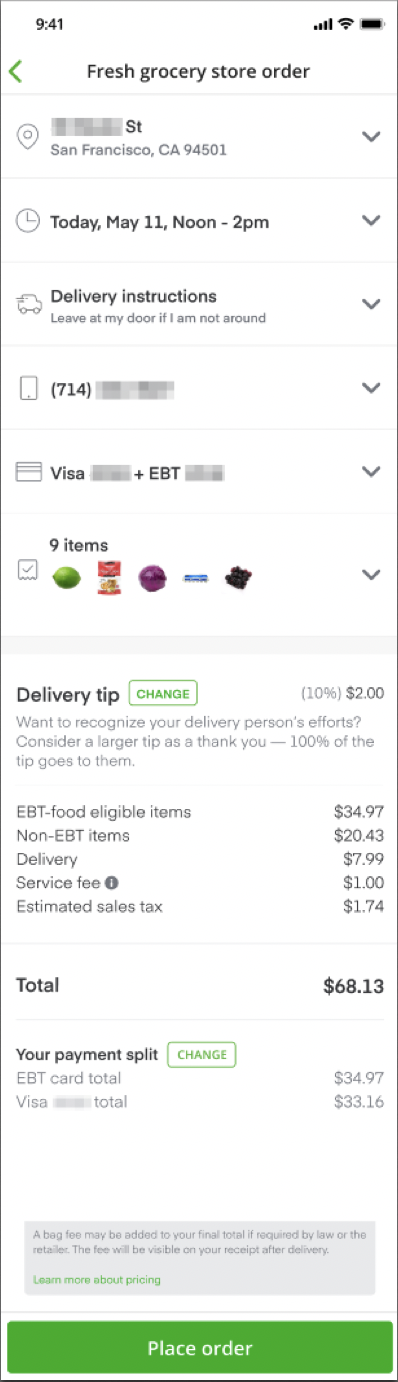

Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

. Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. Like all other taxpayers youll need to file Form 1040. Accurate time-based compensation for Instacart drivers is difficult to anticipate.

You must make quarterly estimated tax payments for the current. The organization distributes no official information on temporary worker pay however they do. Depending on your state youll likely owe 20-25 on your earnings from instacart.

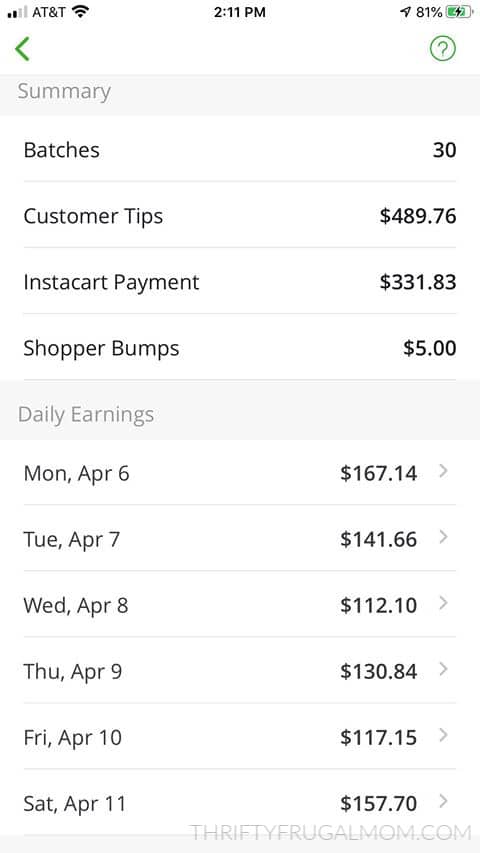

Learn the basic of filing your taxes as an independent contractor. You make 100 as an Instacart Shopper. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour.

With the Instacart Shopper app youll need to. If youre an Instacart shopper you are self-employed that means you likely owe quarterly taxes. Instacart delivery starts at 399 for same-day orders over 35.

Youll include the taxes on your. Your self employment taxes are calculated on Schedule SE and. To actually file your Instacart taxes youll need the right tax form.

Most people know to file and pay their taxes by April 15th. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per. Be sure to file separate Schedule C forms for each separate freelance work that you do ie.

Knowing how much to pay is just the first step. Instacart delivery starts at 399 for same-day orders over 35. Top 10 Tax Deductions for Instacart Personal Shoppers 2022.

By early January 2022. Instacart partners with Stripe to file 1099 tax forms that summarize your earnings. Well what many new Instacart Shoppers or even Instacart veterans will realize is that this isnt the case for the Instacart Shopper app.

Get the scoop on everything you need to know to make tax. There will be a clear indication of the delivery. Instacart Shoppers weve put together a custom tax guide for you complete with insider tips from our tax specialists.

Unfortunately this means you need to pay quite a lot of self employment taxes every year social security and medicare taxes. This tax form summarizes your income for the year deductions and tax. Illustrated with numbers.

First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. You file 100 - 50 50 of income instead of 100. This includes self-employment taxes and income taxes.

There will be a clear indication of the delivery. Put 20 away for the just in. Weve put together some FAQs to help you learn more about how to use Stripe Express to review your.

Your 1099 tax form will be sent to you by January 31 2022 note. So if you have other income like W2 income your extra business income might put you into a higher tax bracket. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

The Instacart 1099 tax forms youll need to file. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Tax tips for Instacart Shoppers.

You spent 50 on a durable bag to help you carry stuff. With TurboTax Live youll be able to get unlimited advice. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Up to 5 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed. Paper forms delivered via mail may take up to an additional 10 business days.

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Top 10 Tax Deductions For Instacart Personal Shoppers 2022 Instacart Shopper Taxes Taxes S2 E82 Youtube

How To Use The Instacart Shopper App Download Login More

What You Need To Know About Instacart 1099 Taxes

How To Make Money As An Instacart Shopper My Undercover Experience The Money Ninja

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Self Employment Tax Explained Gig Economy Taxes Uber Lyft Grubhub Instacart 1099 Taxes Youtube

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

Instacart Help Center Checking Out With Your Ebt Card

Top 10 Tax Deductions For Instacart Personal Shoppers 2022 Instacart Shopper Taxes Taxes S2 E82 Youtube

How To Know Your Taxable Income As An Independent Contractor

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make